If you’re considering a move to senior living, evaluating your financial options is an essential step in the process. An entrance fee is required to become a resident of our life plan community at Otterbein Granville. However, several financial options are available, and our dedicated team can help you determine which is right for you.

To learn more, watch this short video featuring Otterbein Granville’s Director of Sales & Marketing, Melissa Moore, then keep reading to explore all the financial details below.

Understanding Entrance Fees and Contract Options

An entrance fee covers the residence (apartment or cottage) you select and secures your place in the community if your care needs change. This differs from a monthly fee, which covers utilities, your meal plan, housekeeping, maintenance, amenities, and more.

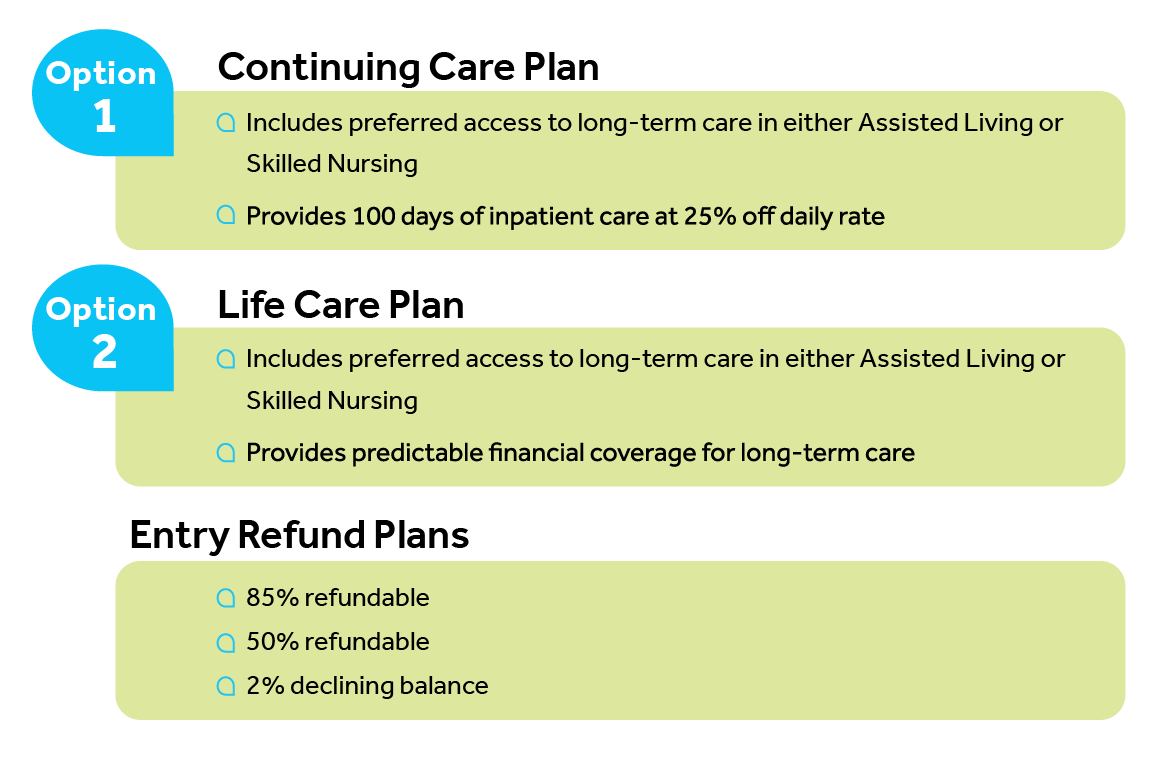

To determine your entrance fee and monthly fee amounts, choose from one of two contract options: the Continuing Care Plan or the Life Care Plan. Both plans include preferred access to continuing care in assisted living or long-term care, but the amount you would pay for additional care can vary, depending on which care plan you choose.

Option 1: Continuing Care Plan

The Continuing Care Plan includes preferred access to higher care in either assisted living or long-term care. This plan provides 100 days of inpatient care at 25% off the daily assisted living or long-term care rate.

The Continuing Care Plan is characterized by a lower entrance fee and less upfront cost. However, once you start receiving assisted living or long-term care, you will be paying the current market price for as long as you receive care.

This option is often preferable for those who:

- Have long-term care insurance

- Are looking for lower, upfront costs

Option 2: Life Care Plan

The Life Care Plan is a prepaid option that also includes preferred access to continuing care in either assisted living or long-term care. This plan provides predictable financial coverage for assisted living and long-term care.

Although the entrance fee is higher for the Life Care Plan, you pay an equalized pricing rate plus a meal charge when accessing these services. This plan also offers potential tax advantages with the prepaid health care portions of the entry and monthly fees.

The Life Care Plan is often desirable for those who:

- Want maximum peace of mind for their future care

- Want to receive tax benefits

Three Entrance Fee Refund Plans to Choose From

In addition to choosing a contract type, you must also select from one of three entrance fee refund plans. The option you decide upon will determine the amount of your entrance fee balance (what’s left over) that will go to your estate once the contract has ended.

Starting with the highest entrance fee option, the three refund plans are:

- 85% refundable

- 50% refundable

- 2% declining balance

Essentially, the higher the entrance fee, the higher the refund amount. For example, if you choose the 85% refund plan, 85% of your entrance fee balance will go to your estate. For the 2% declining balance, the entrance fee balance declines 2% every month for 50 months, at which time there is no refund.

Compare your current living costs to Otterbein Granville’s with this free cost comparison guide >>

How to Pick the Right Financial Option for You

If you’re considering Otterbein Granville for your new home, but are unsure which financial option is best for you, ask yourself the following questions:

- How many people will be living there? Is it just you, or do you have a spouse moving with you?

- Do you have long-term care insurance?

- What’s more important to you right now? Lower upfront cost or more peace of mind for the future?

- Do you want to start paying for future care now or later?

- Are you looking for tax benefits?

- How much would you like to leave to your estate and/or loved ones?

Still not sure? Contact us at Otterbein Granville, and we can answer your questions, help you set up a visit, and more.

This blog was originally published in 2022 but updated with current information in 2025.

Leave a Reply